|

| BitMEX: The Next Generation of Bitcoin Derivatives |

Introduction to The Bitcoin Mercantile Exchange (BitMEX)

The Bitcoin Mercantile Exchange (BitMEX) is a leading digital currency exchange platform that offers Derivatives, Futures, and Prediction contracts and markets for margin trading cryptocurrencies.

BitMEX offers a variety of contract types, and all contracts are bought and paid out in Bitcoin. It is the only platform that offers a "Perpetual P2P Swap", a contract that trades like a future but never expires!

BitMEX touts itself to be a provider of "The Next Generation of Bitcoin Derivatives", and quite rightfully so. The platform has been able to grow significantly, no doubt partly due to their ability to open traders up to various kinds of interesting derivative markets, and keeping their customers happy with transparency, open communication, having strong security in place, and most importantly, a highly advanced yet user-friendly trading platform.

|

| BitMEX: Perpetual P2P Swap Contracts Do Not Expire |

Alternative cryptocurrency markets include Zcash (ZEC), Ethereum (ETH), Ethereum Classic (ETC), Monero (XMR), Ripple (XRP), Augur (REP), Litecoin (LTC), Factom (FCT), Dash (DASH), as well as other derivative prediction markets such as the likelihood of Bitcoin ETF Approval (COIN).

They also offer demo accounts for you to test trading strategies without risking any funds.

How Does Margin Trading on BitMEX Work?

|

| BitMEX: Margin Trading Bitcoin up to 100x Leverage |

Margin Trading refers to borrowing from the broker (trading platform) to either buy or sell a stock.

Depending on which market, BitMEX offers a flexible leverage of up to 100x for Bitcoin markets and up to 33x for Altcoin markets. But that doesn't mean that you should use the maximum available leverage, and in fact, you shouldn't unless you really know what you are doing!

My suggestion for the new traders here is to stick to a leverage of 5x or less, before moving to 10x or higher when you are more comfortable.

Getting Started - Sign Up & Fund Your BitMEX Account

The need for KYC/AML only arises when you need to deposit or withdraw FIAT currency from the exchange. Example, for Bitfinex, you can trade any market using your BTC deposits and withdraw Bitcoin perfectly fine without filling up any forms. You only need to get your account approved when you want to deposit/withdraw USD or Euro etc..

For BitMEX, like most Bitcoin and cryptocurrency exchanges, there is no need to go through KYC/AML document submission and approval process, and you can start trading immediately just by signing up and funding your account!

Keep Your Account SECURE!

After you set up your account, the first thing you should do is to keep your account secure, and I can't emphasize this enough! Here are some things you should do to keep hackers at bay:

- MUST DO: 2FA on both exchange and email account. Once this is done, you should not be able to get compromised, except in rare cases such as sim-jacking. Highly suggest using Google Authenticator / Authy type of 2FA, instead of SMS 2FA which is susceptible to sim-jacking with some social engineering and one lazy telco service operator customer care assistant.

- MUST DO: Use strong passwords; minimum 20 characters with a mix of upper- and lower-case letters, numbers, and characters.

- Optional: Use a separate email address for Bitcoin and cryptocurrency only.

BitMEX Trading Dashboard Walk-through

Now that we've got that out of the way, lets dive straight into navigating around the BitMEX exchange trading dashboard. Below is the landing page you'll see upon logging into your BitMEX account.

For your easy reference, I have split the interface up into three segments:

A) Market Information

B) Account Information

C) Trading Tools & Management

A) Market Information

|

| BitMEX Trading Dashboard Walkthrough: Market Information |

1. Market Overview

Right at the top, you can find the ticker symbols of all the available markets. Clicking on the symbols on the left will toggle between showing the market data of the relevant market, namely current trading price and 24h % gain/loss.

2. Market Selection

You can find a row of markets and their associated tickers in this section. Clicking on each of the markets will load the relevant market information as below.

3. Market Information

In this section, you can find the charts powered by tradingview.com, the order book, and recent trade history. The market that is shown here is the market is chosen in the "Market Selection" section.

4. Market Contract Details

Here you will be able to see information about the contract or market that is chosen in the "Market Selection" section.

B) Account Information

|

| BitMEX Trading Dashboard Walkthrough: Account Information |

5. Dashboard Tabs

Trade, Account, Contracts, References, API

6. Balance

You can view your balance at the top right.

Alternatively, your available trading balance is also shown on the left side under the "Place Order" section.

7. Account Information & Settings

You may access your account information by clicking on your username at the top right, where you can change your currency denomination display, color theme, dashboard layout, and access other account/security and site preference settings.

Alternatively, you can also click on "Account" in the dashboard tabs section to access your account settings.

C) Trading Tools & Management

|

| BitMEX Trading Dashboard Walkthrough: Trading Tools & Management |

8. Place Order

This is where you place your orders by inputting the quantity, price, and other parameters where required.

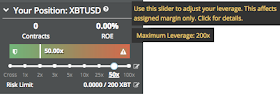

9. Position Overview

Here you can see the overview of your open positions, including the number of contracts, entry price, Return on Equity (ROE), liquidation price, and leverage used. You are also able to adjust the leverage used in your open position.

10. Manage Orders & Positions

Active orders and open positions will appear in this section.

It also shows a history of your orders and fills.

BitMEX Trading Dashboard - Order Types

Now that you are familiar with how to navigate BitMEX's platform, let's move on to the various order types, placing an order, and get to the actual trading proper! Click on the image below to view it in full size.

|

| BitMEX Trading Dashboard Order Types: Overview |

Again, for easy reference, I have split the 7 available order types into 3 groups:

A) Market & Limit Orders

B) Stop Orders

C) Take Profit Orders

Let's go into more detail for each order type below.

A) Market & Limit Orders

Market and Limit orders are the most common types of orders used by traders to enter into a trade/position. These orders are immediately entered into the order book once opened.

1. Market Order

|

| BitMEX Trading Dashboard Order Types: Market Order |

After clicking Buy or Sell, there will be a confirmation page, where you can adjust your desired leverage for the trade.

2. Limit Order

|

| BitMEX Trading Dashboard Order Types: Limit Order |

Similarly, there is a confirmation page where you adjust your desired leverage for the trade.

B) Stop Orders

Stop orders, unlike market or limit orders, do not appear on the order book immediately upon opening. These orders are associated with a trigger price, or "stop price" in the case of BitMEX, whereby your order is only entered into the order book after the stop price is hit. As I shared in my last post about Bitfinex, stop orders are usually used as "stop losses" to get out of a bad trade, but are also extremely effective in buying into breakouts. To read more about how buy breakouts with stop orders and let your winners ride, check out this post about margin trading.

3. Stop Market Order

|

| BitMEX Trading Dashboard Order Types: Stop Market Order |

A Stop Market Order is a market order that is triggered (opens) when your stop price is hit.

For example, if today's BTC price is $1150, and you place a stop market buy order at $1200, your position will not trigger if price trades anywhere below $1199. Once a trade occurs on the market at $1200, your stop market buy order will trigger and a market buy is made.

4. Stop Limit Order

|

| BitMEX Trading Dashboard Order Types: Stop Limit Order |

In the same way that a market order differs from a limit order, a Stop Limit Order works in the same way as a Stop Market Order, except with an additional "limit price" parameter that is triggered only when your stop price is hit.

Further to the example above, if you enter $1200 as the stop price, and $1175 as the limit price, and when a trade occurs on the market at $1200, a limit order at $1175 will be placed.

Alternatively, if you enter $1200 as the stop price, and $1210 as the limit price, this will act almost like a market buy when your trade is triggered (unless there are not enough sells for your purchase quantity up to the limit price - in which case you need to increase the limit price or simply use a stop market order).

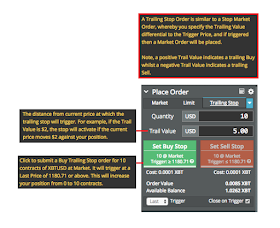

5. Trailing Stop Order

|

| BitMEX Trading Dashboard Order Types: Trailing Stop Order |

Instead of setting a stop price, a Trailing Stop Order makes use of a "Trail Value" parameter to determine when a market order gets triggered. This "Trail Value" is calculated against the market's price at which you entered the position.

For example, if BTC price is $1150 and I have an active buy position, and I open a Trailing Stop Order by entering a "Trail Value" of $5, my active buy position will close when price goes to $1145. Whereas if BTC price is $1200, opening the same trailing stop order will close my active buy position when price goes to $1195.

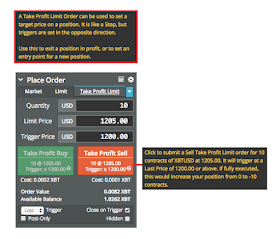

C) Take Profit Orders

Take Profit Orders, as the name suggests, enables you to set a target price on an existing open position to close it and "take profit". This can be done in the form of a market order or limit order.

It simply works in the same way as placing a limit order in the opposite direction of your active position (i.e. placing a limit sell order if you have an active buy position).

Interestingly, just like using a stop to buy a breakout, this order type can also be used to set an entry point for a new position. But unlike a stop order, triggers are set in the opposite direction. To use it in this way, untick the "Close on Trigger" option as this is for closing orders only and will automatically cancel any orders if used to enter/open a position.

See below for a closer look at the Take Profit Market Order and Take Profit Limit Order.

6. Take Profit Market Order

|

| BitMEX Trading Dashboard Order Types: Take Profit Market Order |

7. Take Profit Limit Order

|

| BitMEX Trading Dashboard Order Types: Take Profit Limit Order |

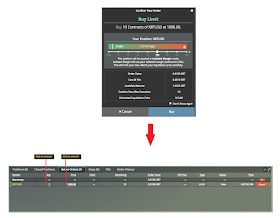

BitMEX Trading Dashboard - Manage Orders & Positions

Upon placing your order or if you have any open positions, you can view and manage them in the middle bottom section of the trading dashboard. You can also view your order history, fills, and closed positions in this section.

|

| BitMEX Trading Dashboard Manage Orders & Positions: Positions Overview |

1. Active Orders

Once you place a limit order (and it doesn't immediately trigger), they will appear in this "Active Orders" tab. You can edit the quantity and price while the order is still open, although you can't change a buy into a sell.

Stop orders and take profit orders will appear in the "Stops" tab.

|

| BitMEX Trading Dashboard Manage Orders & Positions: Active Orders |

2. Open Positions

Once your active order triggers, or when you place a market order, they will appear here in "Positions". You are able to add/remove margin to your position, which changes the liquidation price of your position, as well as to easily place a limit or market order to close your position instead of having to place the order through the "Place Order" section.

|

| BitMEX Trading Dashboard Manage Orders & Positions: Open Positions |

|

| BitMEX Trading Dashboard Manage Orders & Positions: Your Position |

3. Stop Loss & Take Profit

Active stop orders and take profit orders will appear here in the "Stops" tab. You can also edit some parameters, including the quantity, stop price, and limit price, as well as cancel the order.

|

| BitMEX Trading Dashboard Manage Orders & Positions: Stop Loss & Take Profit |

4. Order History

Lastly, you will be able to view all your order history, executed or not, in this "Order History" tab. You can then find all your filled order history in the "Fills" tab, and "Closed Positions" in the corresponding tab.

| BitMEX Trading Dashboard Manage Orders & Positions: Order History |

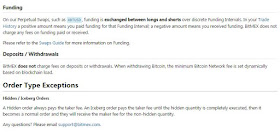

BitMEX Funding, Trading & Withdrawal Fees

Find below a snapshot of the funding, deposit, withdrawal, order execution, and swap fees. See it here: https://www.bitmex.com/app/fees.

|

| BitMEX Funding Trading & Withdrawal Fees |

|

| BitMEX Funding Trading & Withdrawal Fees |

BitMEX Security

Read about the security measures in place on BitMEX from wallet and trading engine security, to system and communication security: https://www.bitmex.com/app/security.

BitMEX API

The platform offers a fully featured REST API and a powerful streaming WebSocket API, making available all market and user data and updates in real-time: https://www.bitmex.com/app/apiOverview.

BitMEX Information Library

Bitmex has their own library of guides and tips on trading on their platform, which cover an extensive range of topics. So I tried to make this post more visual, and cover only what BitMEX themselves did not.

Take a look at these links to learn more about the BitMEX platform:

- Trading Overview: https://www.bitmex.com/app/tradingOverview

- Futures Guide: https://www.bitmex.com/app/futuresGuide

- Swaps Guide: https://www.bitmex.com/app/swapsGuide

- FAQ: https://www.bitmex.com/app/faq

They also have in-depth information about how their platform differs from competitors, for various parameters including liquidation events, contract loss mechanisms, max leverage, initial margin, maintenance margin, settlement mechanisms, minimum contract sizes, and many more!

See the comparison here: https://www.bitmex.com/app/whatsDifferent

Conclusion

I hope that this post gives you a good overview of how to use BitMEX trading exchange platform to view markets, open orders, enter into positions, as well as teach you how to use each of the different order types.

| 1Broker: Trade Global Markets with Bitcoin - Forex, Stocks, Indexes, Commodities |

In my next post, I will prepare a similar tutorial for using 1Broker, which offers something different from Bitfinex or BitMEX, by having global markets such as Forex, Stocks, Indexes and Commodities available to traders. In addition, I also hope to share some tips on crafting your perfect trading strategy, and the importance of risk management and position sizing management. Stay tuned!

If you have any suggestions or comments, please feel free to leave them below.

Thank you for reading, and good luck trading!

Omg, man! Where is your BTC wallet? Do you accept some cryptocoins as payment for you guide? =D

ReplyDeletethat's excellent!

ReplyDeletecan you do the same for kraken :)

Thanks man!

ReplyDeleteExcellent article.

Here is a tip: You should post it in steemit.com and get some steem coins!

The crucial key that the prices are dependent on the emotions of the investors and traders is really what I believe in. This was not as much as an eye opener but some of the topics you threw light upon was actually on the grey area of my head and you brought a crisp clear understanding of these. Thanks.

ReplyDelete